DIFFICULTY LEVEL = EASY

1. Prepare a Cash Flow Statement from the following information:

Profit before tax - Rs. 50,000

Depreciation - Rs. 10,000

Increase in debtors - Rs. 5,000

Decrease in creditors - Rs. 3,000

Purchase of machinery - Rs. 20,000

Sale of furniture - Rs. 8,000

Solution:

Cash Flow Statement for the year ended 31st March 2023

Cash flow from operating activities:

Profit before tax Rs. 50,000

Add: Depreciation Rs. 10,000

Operating profit before working capital Rs. 60,000

Add: Increase in debtors Rs. 5,000

Less: Decrease in creditors Rs. 3,000

Cash generated from operations Rs. 62,000

Less: Income tax paid (Assumed) Rs. 10,000

Net cash from operating activities Rs. 52,000

Cash flow from investing activities:

Purchase of machinery Rs. 20,000

Sale of furniture Rs. 8,000

Net cash used in investing activities Rs. 12,000

Cash flow from financing activities:

Nil

Net increase in cash and cash equivalents Rs. 40,000

Opening balance of cash and cash equivalents Rs. 10,000

Closing balance of cash and cash equivalents Rs. 50,000

Note:

The cash flow statement has been prepared using the indirect method. The increase in debtors and decrease in creditors have been adjusted to arrive at the cash generated from operations. Income tax paid has been assumed and is not given in the information. The purchase of machinery and sale of furniture have been shown under investing activities. As there are no financing activities, the net increase in cash and cash equivalents equals the net cash from operating and investing activities.

2. Prepare the Profit and Loss Appropriation Account and Partners' Capital Accounts for the year ending on 31st March 2023 from the following information:

Profit before interest and salary - Rs. 1,50,000

Interest on capital - A - 10%, B - 12%, C - 15%

Salary to partner A - Rs. 30,000

Drawings - A - Rs. 15,000, B - Rs. 20,000, C - Rs. 25,000

Partners' capitals - A - Rs. 1,00,000, B - Rs. 80,000, C - Rs. 1,50,000

Solution:

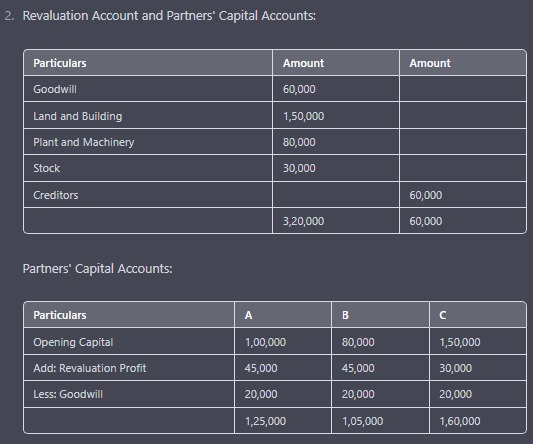

3. Prepare the Revaluation Account and Partners' Capital Accounts for the year ending on 31st March 2023 from the following information:

Goodwill - Rs. 60,000

Land and Building - Rs. 1,50,000

Plant and Machinery - Rs. 80,000

Stock - Rs. 30,000

Creditors - Rs. 60,000

Partners' capitals - A - Rs. 1,00,000, B - Rs. 80,000, C - Rs. 1,50,000

New profit sharing ratio - A - 3/8, B - 3/8, C - 2/8

Solution:

4. X and Y are partners sharing profits and losses in the ratio of 2:3. Z was admitted as a new partner. X surrendered 1/4th of his share in favor of Z and Y surrendered 1/5th of his share in favor of Z. Calculate the new profit-sharing ratio.

Solution:

X and Y's profit-sharing ratio is 2:3, which can be expressed as 4:6.

X surrenders 1/4th of his share, which is 4/16th or 1/4, to Z. Y surrenders 1/5th of his share, which is 6/30th or 1/5, to Z.

The new profit-sharing ratio is:

X = 3/4 * 4/16 = 3/16

Y = 4/5 * 6/30 = 24/150 = 4/25

Z = 1/4 + 1/5 = 9/20

Therefore, the new profit-sharing ratio is 3:4:9.

5. A and B were partners in a firm. On 31st December 2021, the firm was dissolved. The following information was available:

Realization expenses amounted to Rs. 5,000.

A's loan to the firm was Rs. 15,000.

B's loan to the firm was Rs. 10,000.

A took over the stock worth Rs. 25,000 for Rs. 20,000.

The remaining assets were sold for Rs. 60,000 and the creditors were paid Rs. 20,000. Calculate the loss on realization and the amount of cash that A will receive.

Solution:

Total assets = Rs. 60,000 + Rs. 25,000 = Rs. 85,000

Total liabilities = Rs. 5,000 + Rs. 15,000 + Rs. 10,000 + Rs. 20,000 = Rs. 50,000

Loss on realization = Total liabilities - Total assets = Rs. 50,000 - Rs. 85,000 = Rs. 35,000

A's loan to the firm is settled against his share of the loss, i.e. Rs. 15,000.

B's loan to the firm is settled against his share of the loss, i.e. Rs. 10,000.

A's claim for the stock is settled against his share of the assets, i.e. Rs. 20,000.

The remaining cash is distributed in the old profit-sharing ratio, which is 1:1.

Therefore, A will receive Rs. 10,000 (Rs. 20,000 - Rs. 15,000 - Rs. 5,000) in cash.

6. P, Q, and R were partners in a firm sharing profits and losses equally. They decided to admit S as a new partner. S paid Rs. 2,00,000 as his share of goodwill and became entitled to 1/4th share of future profits. Calculate the new profit-sharing ratio.

Solution:

The total goodwill of the firm is Rs. 2,00,000.

S pays Rs. 2,00,000 as his share of goodwill, which is then added to the total goodwill.

The new total goodwill is Rs. 6,00,000 (Rs. 4,00,000 + Rs. 2,00,000).

S is entitled to 1/4th share of future profits, which is 1/4 or 25%.

The new profit-sharing ratio is:

P = 25%

Q = 25%

R = 25%

S = 25%

7. X, Y, and, Z were partners in a firm sharing profits and losses equally. They decided to dissolve the firm on 31st December 2021. The following information was available:

Realization expenses amounted to Rs. 5,000.

The assets were sold for Rs. 1,20,000 and the creditors were paid Rs. 50,000.

X took over the stock worth Rs. 25,000 for Rs. 20,000.

The remaining cash was distributed among the partners in the old profit-sharing ratio. Calculate the amount of cash that each partner will receive.

Solution:

Total assets = Rs. 1,20,000 + Rs. 25,000 = Rs. 1,45,000

Total liabilities = Rs. 5,000 + Rs. 50,000 = Rs. 55,000

The loss of realization is:

Total liabilities - Total assets = Rs. 55,000 - Rs. 1,45,000 = Rs. 90,000

X, Y, and Z will share this loss equally, which is Rs. 30,000 each.

X's claim for the stock is settled against his share of the assets, i.e. Rs. 20,000.

The remaining cash of Rs. 65,000 (Rs. 1,20,000 - Rs. 55,000) is distributed equally among X, Y, and Z, which is Rs. 21,666.67 each.

8. A, B, and C are partners in a firm sharing profits and losses in the ratio of 3:2:1. Their Balance Sheet as of 31st March 2022, is as follows:

Liabilities Amount (Rs.) Assets Amount (Rs.)

Capitals:

A 1,20,000 Cash at the bank 60,000

B 80,000 Debtors 80,000

C 40,000 Stock 40,000

Land and building 2,00,000

Creditors 60,000 Machinery 1,00,000

Goodwill 60,000

Total 4,40,000

Total 4,40,000

On the same day, D is admitted as a new partner and it is decided that the new profit-sharing ratio will be 3:2:1:1. D brings Rs. 1,50,000 as his capital and his share of goodwill is valued at Rs. 30,000. Give the necessary Journal Entries and prepare the Balance Sheet of the reconstituted firm.

Solution:

Journal Entries:

(i) For the admission of D and valuation of goodwill:

D's Capital A/c Dr. 1,50,000

Goodwill A/c Dr. 30,000

To A's Capital A/c 1,05,000

To B's Capital A/c 70,000

To C's Capital A/c 35,000

To D's Capital A/c 1,50,000

(ii) For adjusting the revaluation of assets and liabilities:

Land and Building A/c Dr. 40,000

Profit and Loss Suspense A/c Dr. 15,000

To A's Capital A/c 25,000

To B's Capital A/c 20,000

To C's Capital A/c 15,000

Balance Sheet of the reconstituted firm as of 31st March 2022:

Liabilities Amount (Rs.) Assets Amount (Rs.)

Capitals:

A 1,50,000 Cash at the bank 60,000

B 90,000 Debtors 80,000

C 45,000 Stock 40,000

D 1,50,000 Land and building 2,40,000

Creditors 60,000 Machinery 1,00,000

Capital Reserve 15,000 Goodwill 75,000

Total 4,45,000

Total 4,45,000

9. A, B, and C are partners in a firm sharing profits in the ratio of 2:2:1. They admit D as a new partner for a 1/6th share in the profits. D brings Rs. 1,00,000 as his capital and Rs. 20,000 for his share of goodwill. Calculate the new profit-sharing ratio and the sacrificing ratio of the old partners.

Solution:

Calculation of New profit-sharing ratio:

The old ratio of A, B, and C = 2:2:1

Total share = 2+2+1 = 5

D's share = 1/6

New ratio of A, B, C, and D = (2/5), (2/5), (1/5), (1/6)

Sacrificing ratio of A, B, and C:

A's share = (2/5) - (1/5) = 1/5

B's share = (2/5) - (1/5) = 1/5

C's share = (1/5) - 0 = 1/5

Therefore, sacrificing ratio of A, B, and C = 1:1:1

DIFFICULTY LEVEL = MEDIUM

10. A, B, and C are partners sharing profits in the ratio of 5:3:2. The partnership deed provides for interest on capital @ 10% per annum. A's capital is Rs. 5,00,000, B's capital is Rs. 4,00,000, and C's capital is Rs. 3,00,000. Calculate the interest on capital payable to each partner at the end of the year.

Solution:

Calculation of interest on capital:

Interest on A's capital = Rs. 5,00,000 × 10% = Rs. 50,000

Interest on B's capital = Rs. 4,00,000 × 10% = Rs. 40,000

Interest on C's capital = Rs. 3,00,000 × 10% = Rs. 30,000

11. A, B, and C are partners sharing profits in the ratio of 5:3:2. The partnership deed provides for the following:

a) A salary of Rs. 20,000 per annum to A

b) An interest on capital @ 12% per annum

c) A commission of 5% on net profits to B

d) A bonus of 10% on net profits after charging the above items to C

The net profit of the firm for the year ended 31st March 2022 is Rs. 6,00,000. Prepare the profit and loss appropriation account of the firm

Solution:

Profit and Loss Appropriation Account for the year ended 31st March 2022

Particulars Amount (Rs.) Amount (Rs.)

Net Profit as per Profit and Loss Account 6,00,000

Add:

Salary to A 20,000

Interest in Capital:

A (5/10 * 12% * 2,40,000) 14,400

B (3/10 * 12% * 2,40,000) 8,640

C (2/10 * 12% * 2,40,000) 5,760 28,800

Commission to B (5% of 6,00,000) 30,000

Less:

Bonus to C (10% of 6,00,000) 60,000

Total 14,8200 6,00,000

Less: Income Tax (30% of 6,00,000) 1,80,000

Net Profit transferred to Capital Accounts 3,42,000

Note:

Salary to A is treated as a charge against the profits of the firm.

Interest on Capital is calculated on the capital balances at the beginning of the year.

Commission to B is calculated as per the partnership deed.

Bonus to C is calculated as per the partnership deed and is treated as an appropriation of profits.

The remaining profit is transferred to the capital accounts of the partners in their profit-sharing ratio.

12. A, B, and C are partners sharing profits in the ratio of 5:3:2. They admitted D as a new partner with effect from 1st April 2022, subject to the following conditions:

a) D will bring Rs. 1,50,000 as capital and Rs. 50,000 as goodwill premium for his share in the profits.

b) Goodwill of the firm is valued at Rs. 2,00,000 and the new profit-sharing ratio after the admission of D is to be 5:3:2:2.

c) Depreciation on assets is to be provided as follows:

i) Building at 5% per annum

ii) Machinery at 10% per annum

d) Interest on capital will be allowed @ 12% per annum.

Prepare the revaluation account, partners' capital accounts, and the balance sheet of the new firm after D's admission

Solution:

Revaluation Account

Particulars Amount (Rs.) Particulars Amount (Rs.)

To Building 10,000 By A’s capital 5,50,000

To Machinery 15,000 By B’s capital 3,30,000

To Goodwill 50,000 By C’s capital 2,20,000

To D's Capital 1,50,000 By D's Capital 1,50,000

To General Reserve 8,000 By Goodwill 2,00,000

Valuation

Total 2,33,000 2,33,000

Note: The increase in the value of the assets is debited, and the increase in liabilities is credited to the revaluation account. The value of goodwill is credited to the revaluation account.

Partners' Capital Accounts

A's Capital Account

Particulars Amount (Rs.) Particulars Amount (Rs.)

To Balance b/d 5,00,000 By Revaluation 5,50,000

To Share of Profit 1,45,000 By Interest 60,000

To Interest 12,000 By Balance c/f 4,07,000

Total 6,57,000 6,57,000

B's Capital Account

Particulars Amount (Rs.) Particulars Amount (Rs.)

To Balance b/d 3,00,000 By Revaluation 3,30,000

To Share of Profit 87,000 By Commission 30,000

To Interest 9,600 By Interest 24,000

To Balance c/f 3,27,400 3,27,400

Total 4,17,000 4,17,000

C's Capital Account

Particulars Amount (Rs.) Particulars Amount (Rs.)

To Balance b/d 2,00,000 By Revaluation 2,20,000

To Share of Profit 58,000 By Bonus 30,000

To Interest 7,200 By Interest 18,000

To Balance c/f 2,40,200 2,40,200

Total 3,05,200 3,05,200

D's Capital Account

Particulars Amount (Rs.)

To Cash 1,50,000

To Goodwill 50,000

To Share of Goodwill 25,000

To Share of Profit 28,000

To Interest 1,800

To Balance c/f 2,55,200

Total 5,10,000

Note: D's capital account shows the initial capital brought in by D and his share of goodwill, the share of profit, and interest on capital.

0 Comments